50 20 30 Budget

Oct 17, 19 · The 50//30 Budget Rule and Debt Note about debt First of all, if you have a large amount of outstanding consumer debt, the best decision for the financial health and future is to get rid of it as soon as possible The borrow is truly a slave to the lender and having debt restricts your financial freedom Additionally, let any unexpected.

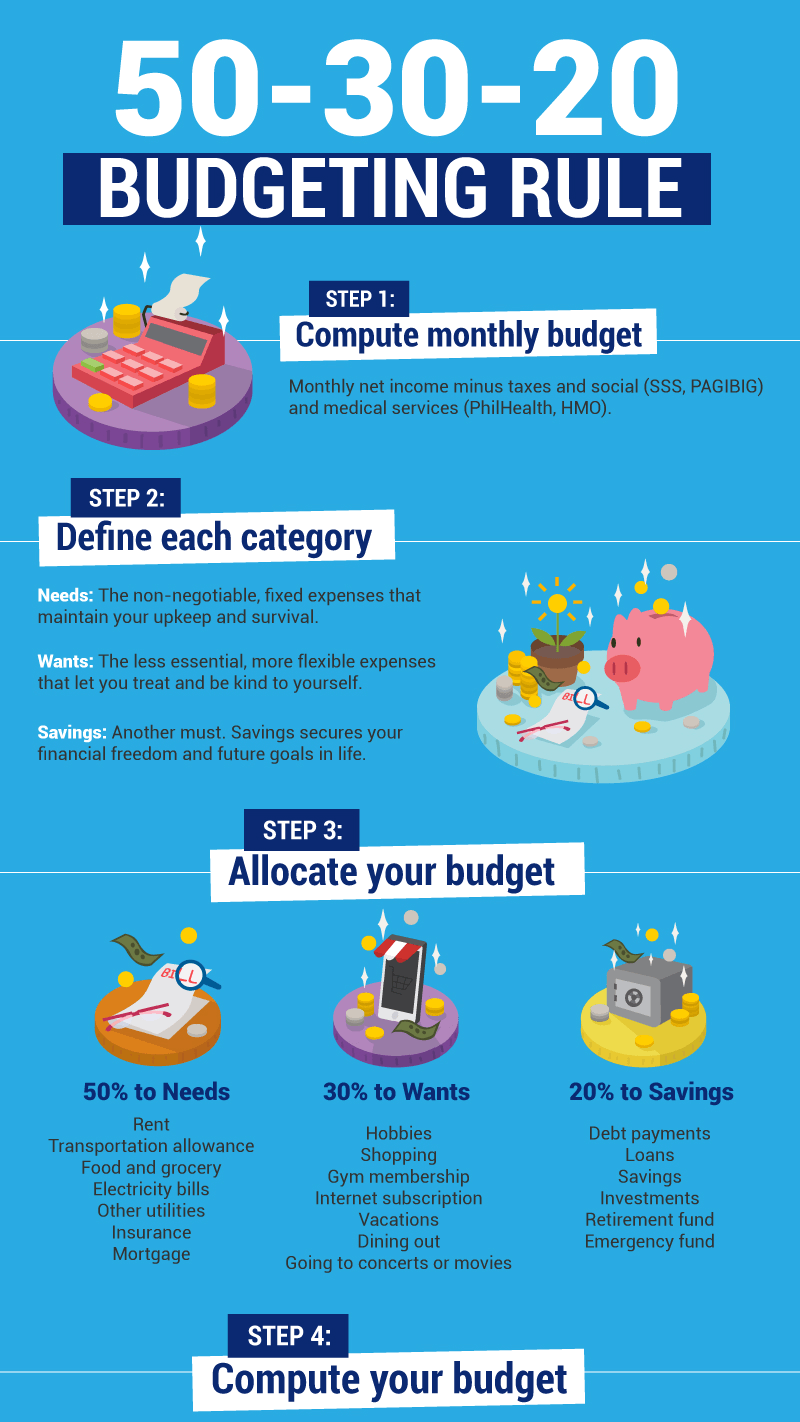

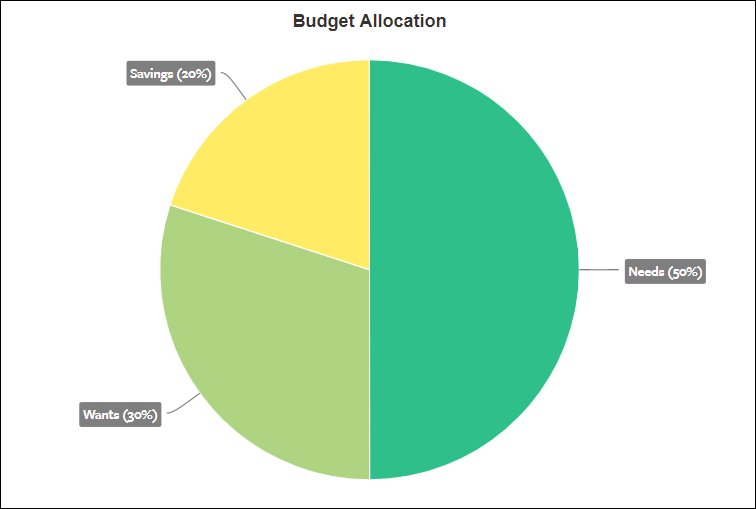

50 20 30 budget. The 5030 budgeting method, coined by Elizabeth Warren and Amelia Warren Tyagi, is a supereasy way to. Jan 03, · The 50/30/ rule is a budgeting framework that outlines what percentage of your income to allocate for the three of the most important parts of your budget The premise is simple — you allocate 50% of your budget for your essentials, 30%. 50% of your aftertax income goes towards needs;.

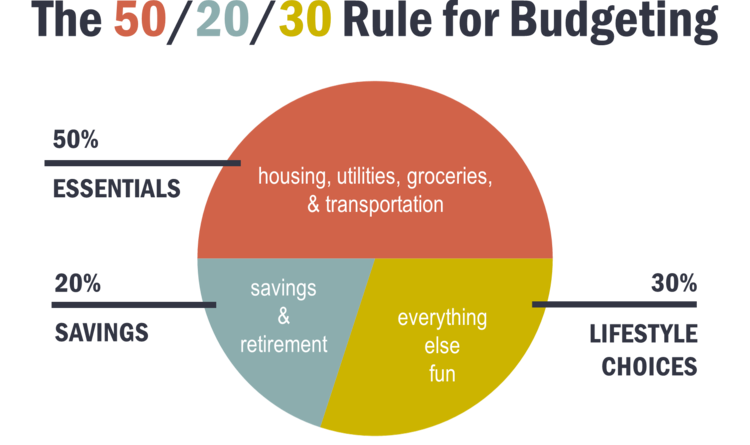

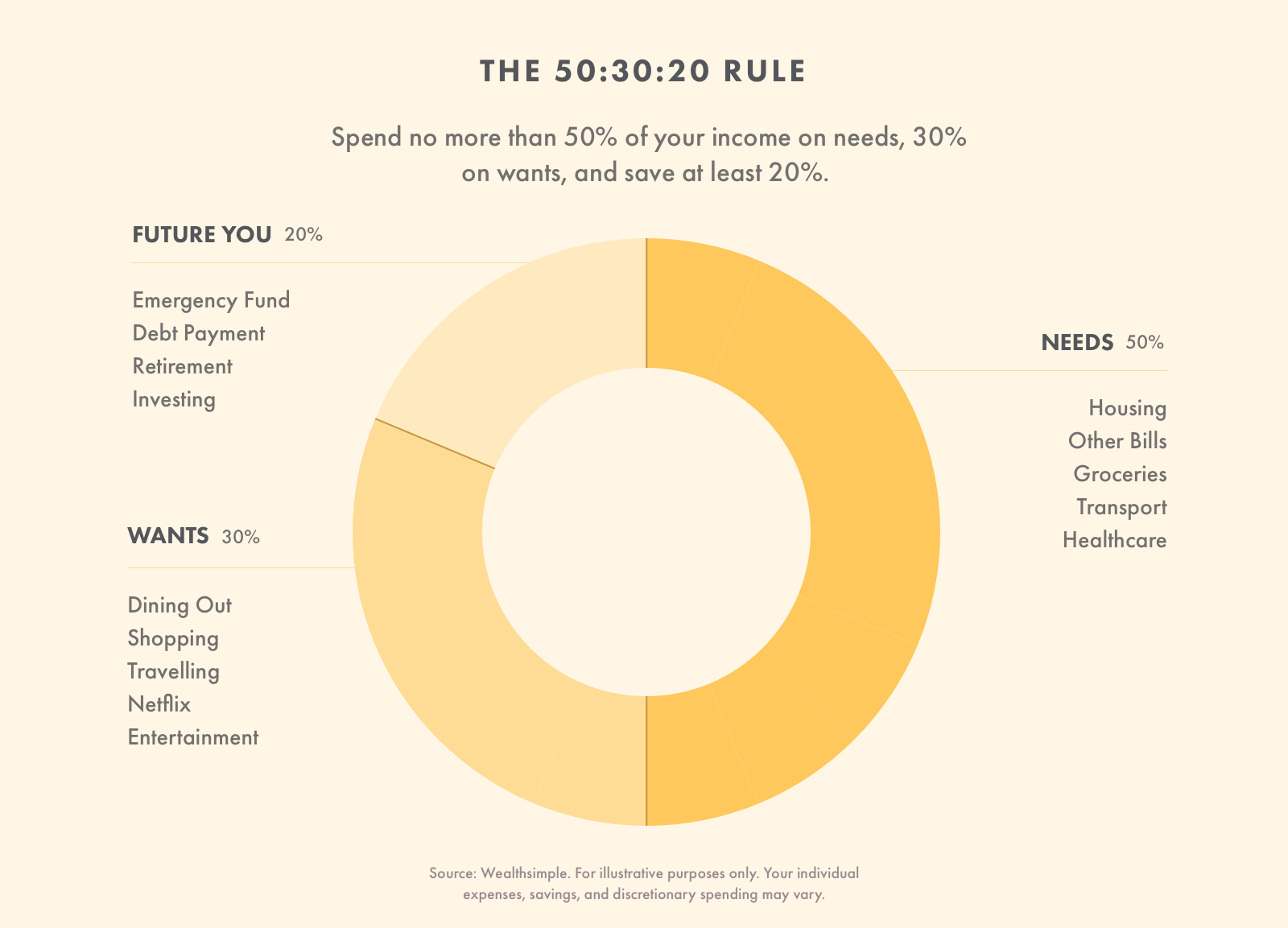

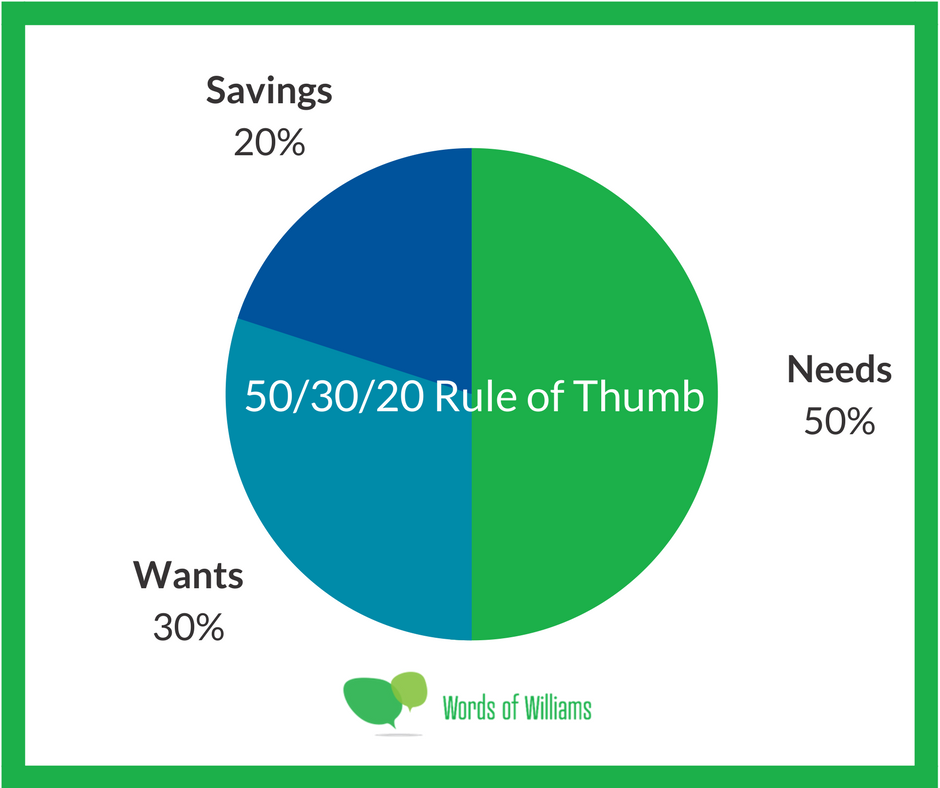

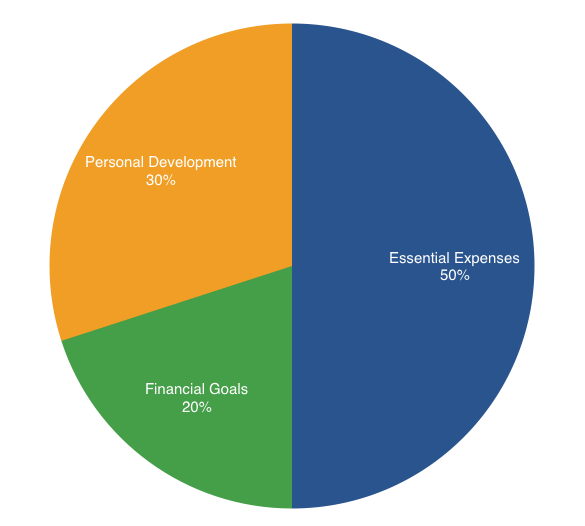

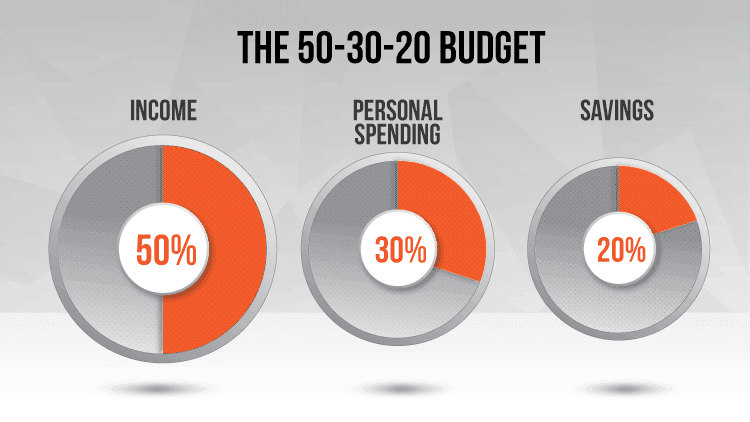

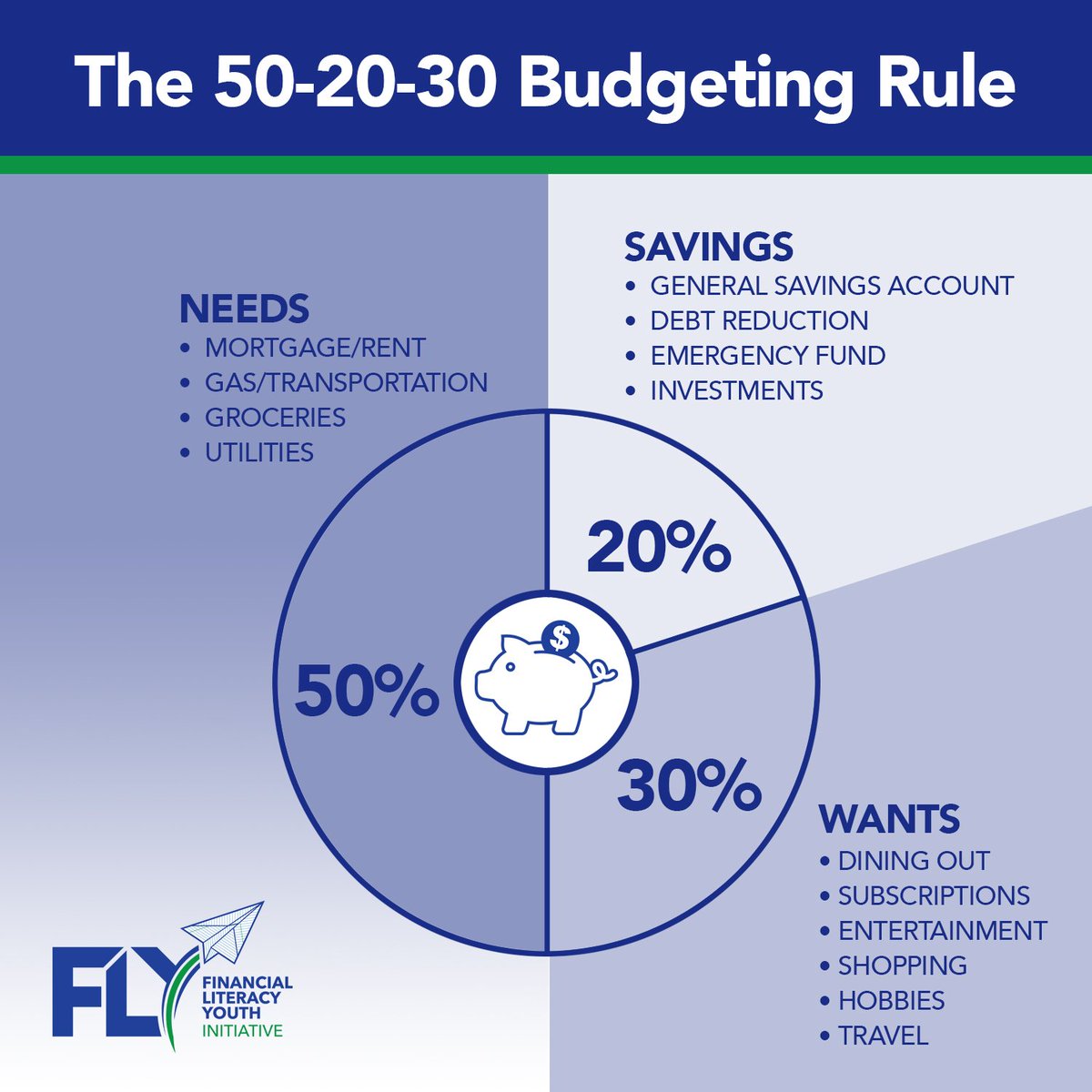

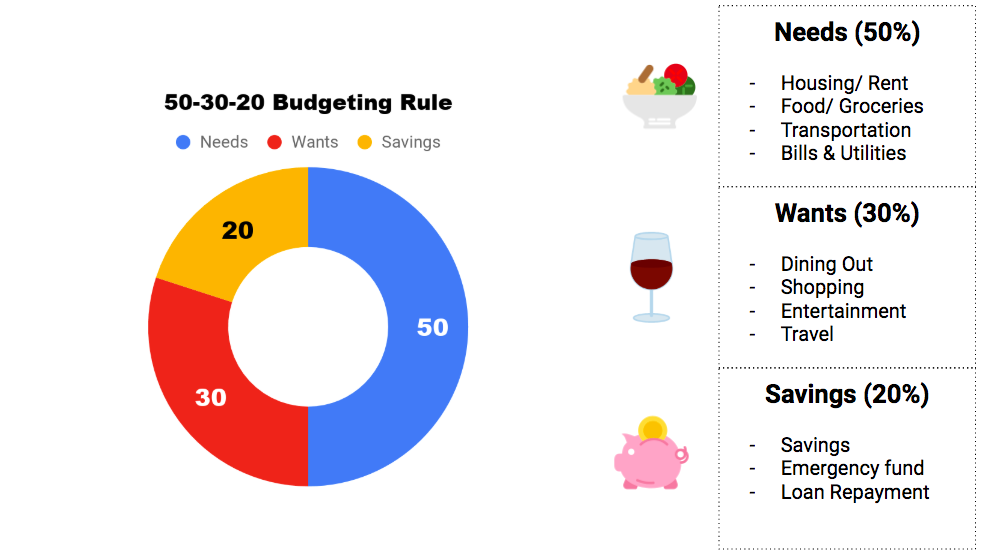

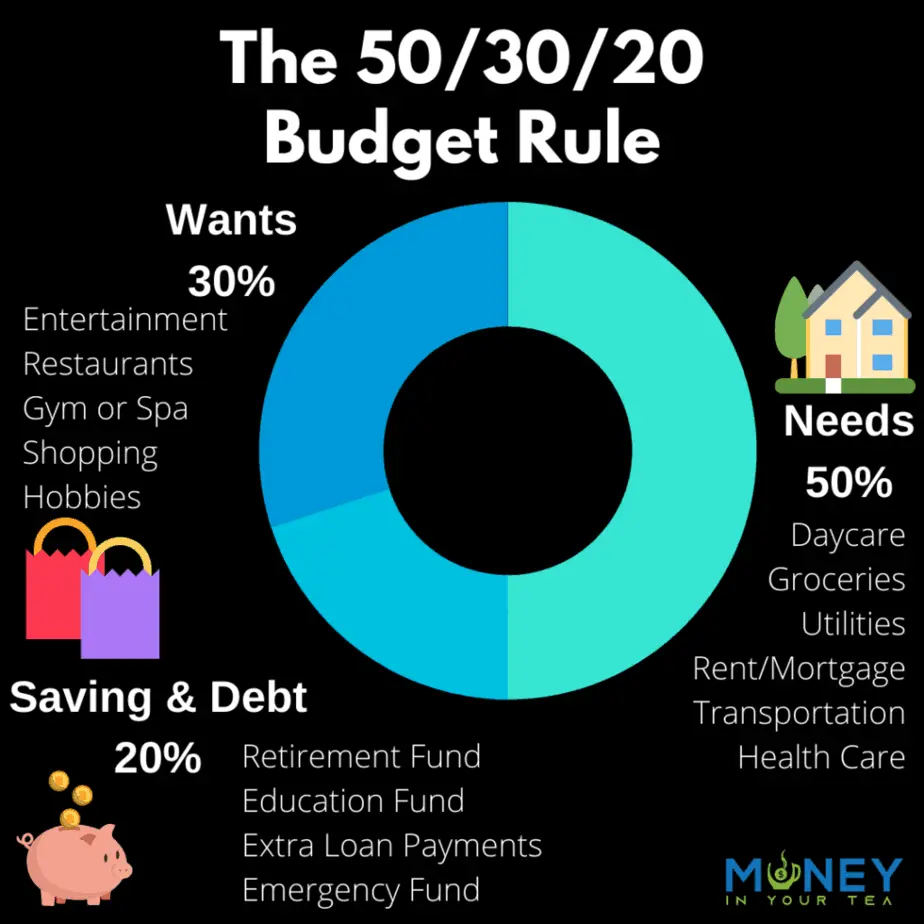

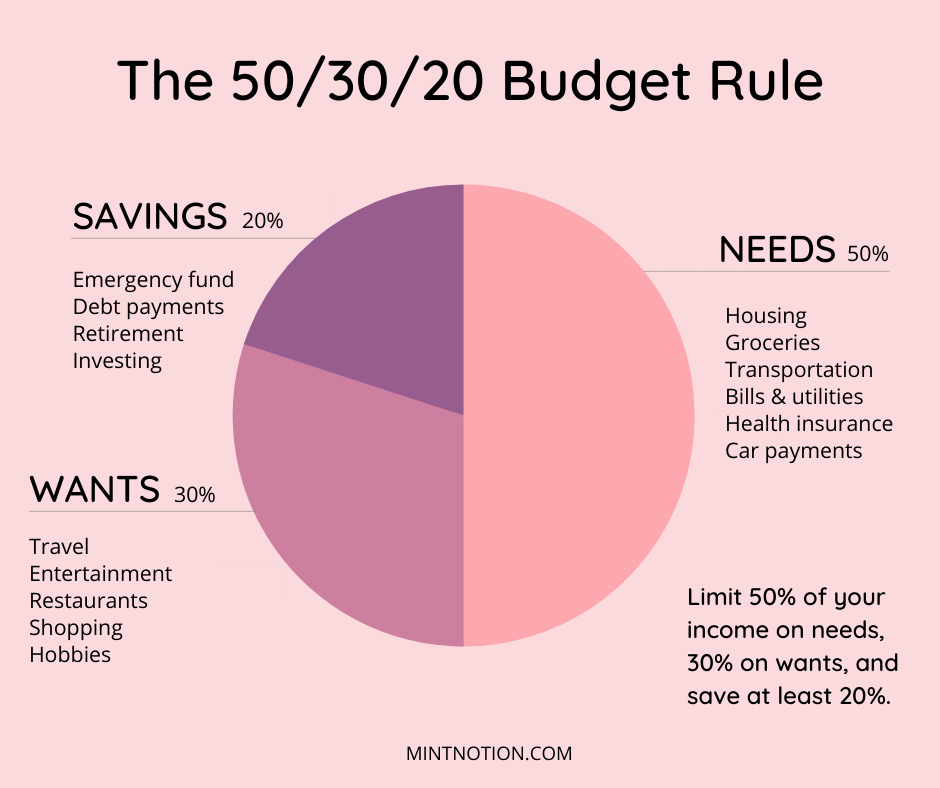

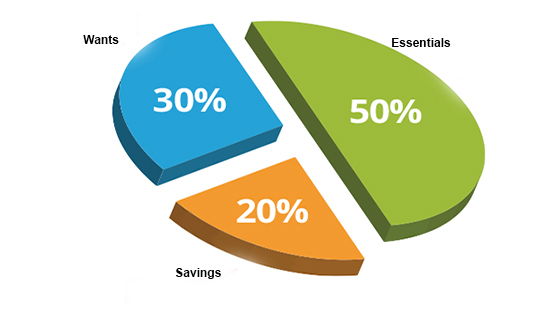

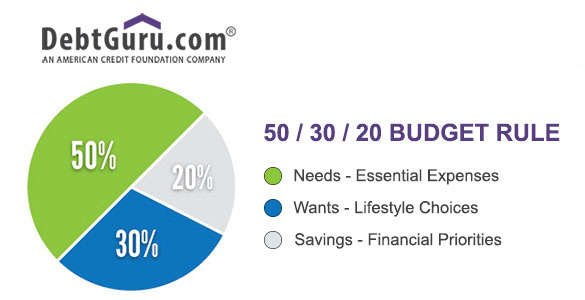

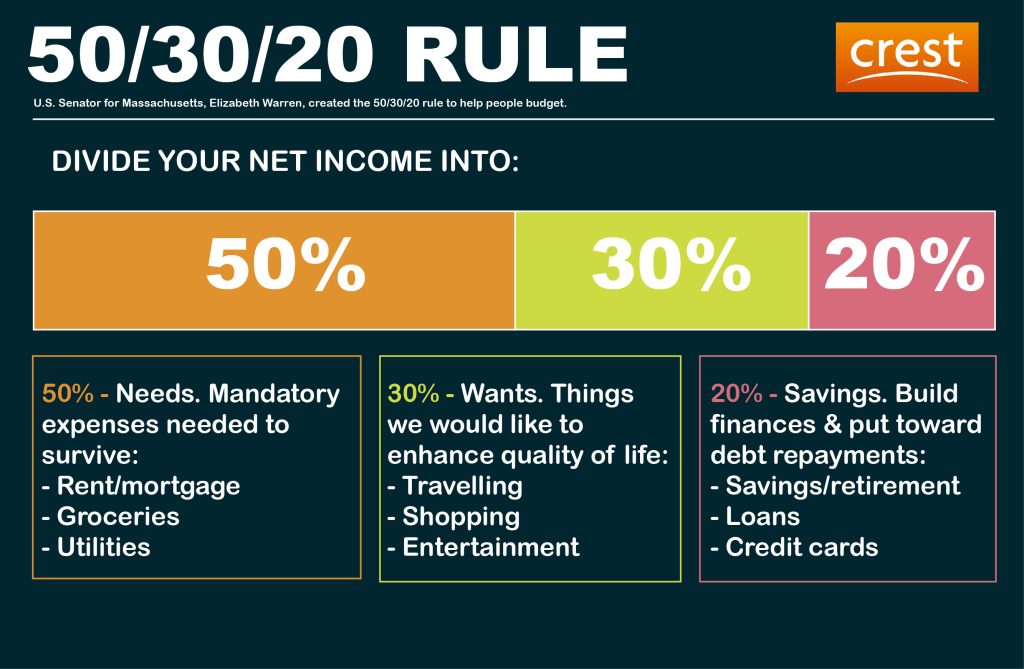

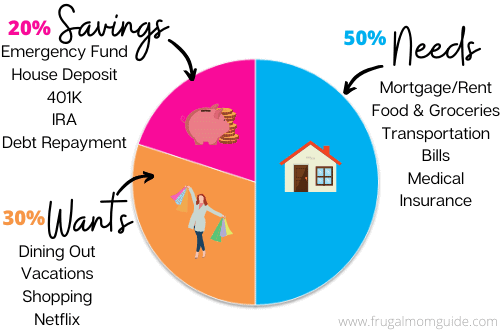

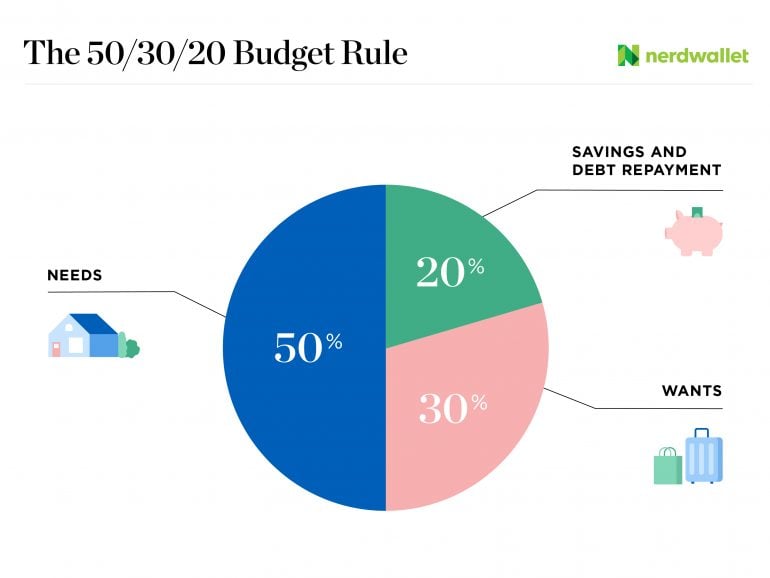

More macrooriented couples would appreciate this framework as they have a bigpicture view of their finances Others who want to save for the future without depriving themselves of spending now may find this budget more sustainable. The 5030 Rule helps to build a budget by following three spending categories Needs, Debt/Savings, and Wants 50% of your net income should go towards living expenses and essentials (Needs), % of your net income should go towards debt reduction and savings (Debt Reduction and Savings), and 30% of your net income should go towards discretionary spending (Wants). One reason for the 50/30/ budget method’s success is how applicable it is By focusing on percentages (rather than exact spending amounts), this method can be applied to the lives of many people.

Is the 50/30/ budget rule good?. 30% is allocated to wants. The 50//30 rule for budgeting attempts to simplify the budgeting process Essentially, you divvy your take home pay into percentages defined by your budget With the 50//30 budget, fifty percent of your money is set aside for needs, twenty percent for savings or debt repayment, and thirty percent is earmarked.

Jul 19, 19 · The 50//30 budget rule was created by Elizabeth Warren, the author of “All Your Worth The Ultimate Lifetime Money Plan” This rule is meant to be used when sorting out aftertax income and is divided into the following categories 50% on needs, 30% on wants and % savings. Mar 29, 19 · The 50//30 budget plan was popularized by Sen Elizabeth Warren, a bankruptcy expert, and her daughter, business executive Amelia Warren Tyagi, in their coauthored book, “All Your Worth The Ultimate Lifetime Money Plan” The goal is to break down your monthly aftertax income and focus your spending in three broad categories. Apr 07, 21 · What is the 5030 budget?.

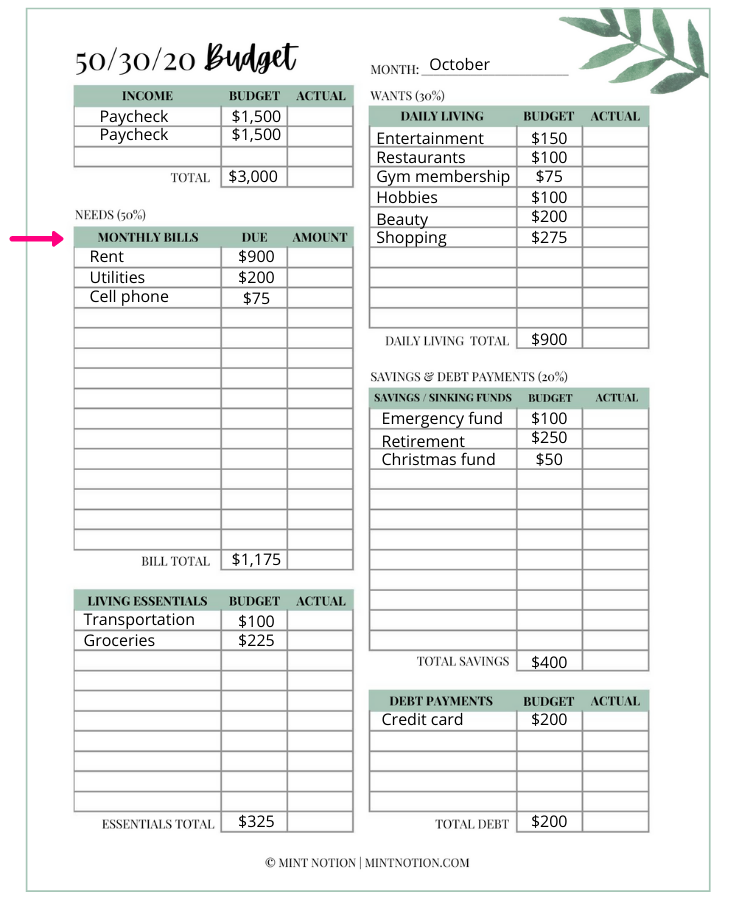

Aug 04, · The 50/30/ rule is a budgeting rule of thumb that can help you make everyday spending decisions without having to track every penny you spend The rule states that you should spend 50 percent of. Dec 12, 19 · Using this method, 50% of your budget goes to pay for necessities, 30% or less to discretionary items, and % or more to savings and debt payments Making a budget is an important step in gaining control of spending and paying off debt But when you're new to budgeting, it can feel intimidating and restrictive The 50/30/ rule can be a smart. At its basic level, the 5030 budget divides your aftertax, takehome pay into three buckets The first 50% of your budget goes towards necessities, including.

Jun 22, 19 · What Is The 50 / / 30 Rule?. Feb 18, · A 50 30 budget refers to a formula for dividing up your aftertax income to help reach financial goals Popularized in Senator Elizabeth Warren’s book, All Your Worth The Ultimate Lifetime Money Plan, the 50/30/ rule provides a mathematical formula for dividing your earnings among needs, wants, and savings. Feb 28, 17 · The 50/30/ Rule How To Budget Your Money I also found a common mantra the 50/30/ budget rule This is a simple budget breakdown that says 50% Essentials — Things like rent, food, gas, etc 30% Personal — Goes toward personal expenses such as travel, meals out or your cellphone bill % Savings — For retirement and paying down debt.

May 02, 19 · The 50/30/ Budget Simplifies Managing Your Money Overall, consumers who like and stick with the 50/30/ budget do so because of how simple it is There’s little doubt on how to categorize expenses, and evaluating your spending can take just a few minutes each week. Apr 13, · Who is the 50//30 Budget For?. If the 5030 budget doesn’t fit your lifestyle, try one of these instead While it might be easy to remember, the rule isn’t always easy to live by The fact is when it comes to expenses one size doesn’t fit all For example, people living in cities like New York or San Francisco, may need to spend almost their full paycheck on rent.

Feb 25, 17 · 50/30/ budget calculator Our 50/30/ calculator divides your takehome income into three categories 50% for needs, 30% for wants and % for savings and debt repayment The 50/30/ budget Find. If you start a budget with the 5030 rule, you can more easily tell you if you’re spending more than you can really afford, particularly on living expenses and necessities “The 5030 rule makes you look at your necessities, such as housing and utilities, and make them fit under that 50 percent umbrella,” Omoth says. Jan 14, · The 5030 budgeting rule is a simple plan to manage your money It’s perfect if you’re looking for an easy budget strategy or new to budgeting I’ll break it down for you here and provide a 50 30 rule and spreadsheet.

Oct 25, 18 · A decent budget ensures that you pay your bills on time — and nothing more But a successful budget means you have a grasp on what you’re spending your money on and what you’re saving for The 50/30/ budget is a popular option to make that happen What is the 50/30/ Budget?. Oct 09, 19 · 50//30 budgeting is useful if you want to Get on top of debt Save steadily over the longterm Cover essential costs more reliably Avoid a very detailed budget How to create a 50//30 budget 1 Work out your monthly income after tax This is usually the net pay figure on your payslip It may also include things like bonuses and tips. Aug 14, 17 · One of these is the 50//30 rule, which uses just three budget categories to help you prioritize your spending We spoke to Xavier Epps, a personal finance expert and owner of XNE Financial Advising, about this plan and how it can be implemented to help people manage their finances effectively.

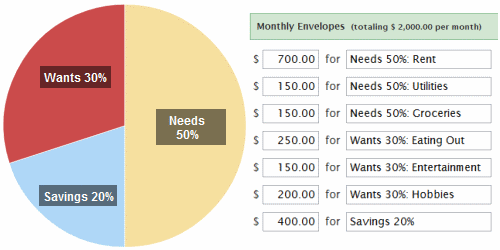

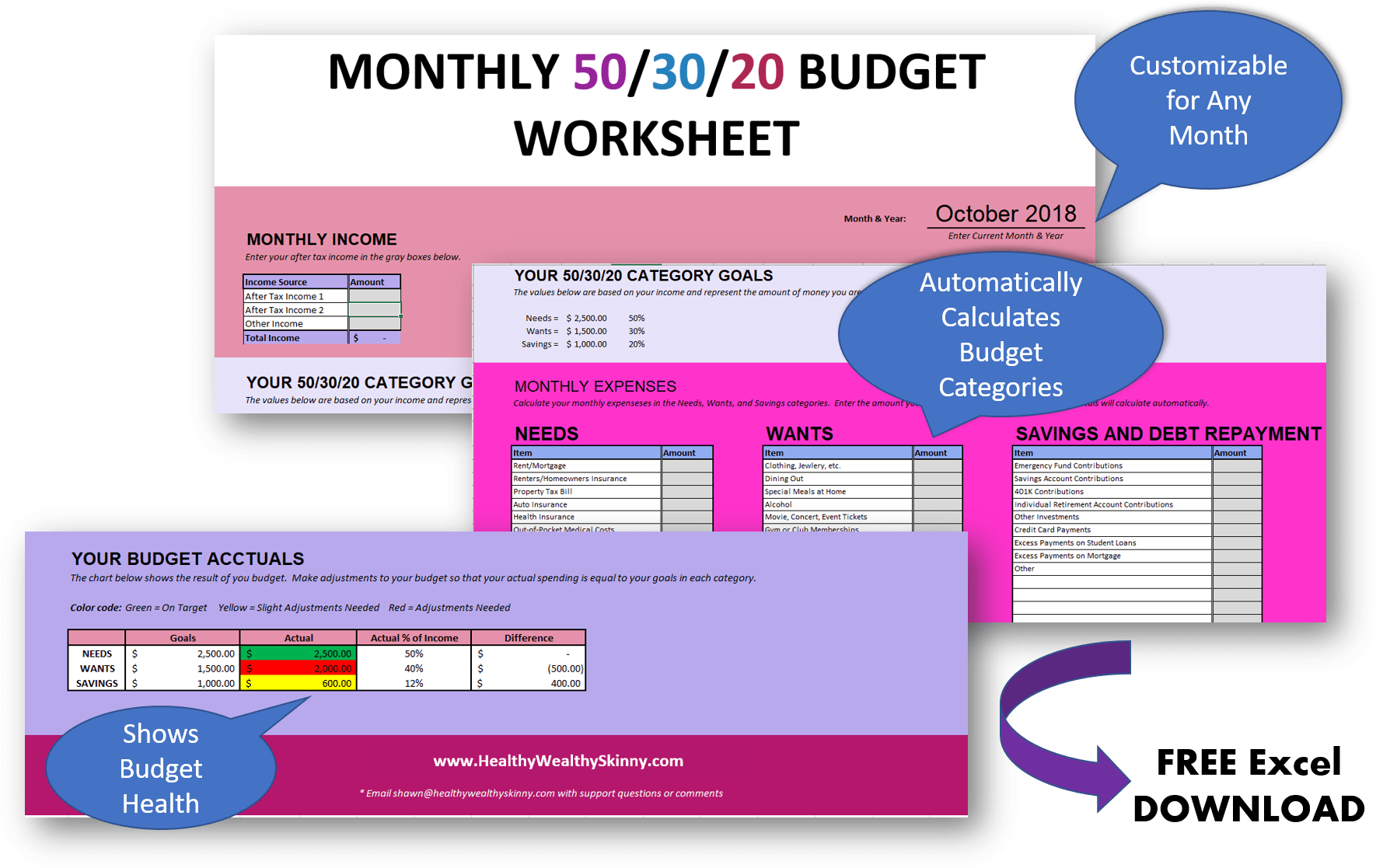

Jun 04, · Let’s take a look at an example budget to show you how it might look when you first set up your 50//30 budget, which you can do in a simple spreadsheet or by using a budgeting app and taking a. The name 50 / / 30 rule comes from the divisions your income receives for budgeting purposes What makes this form of budgeting so very special is that there are only three true budget categories. Mar 11, · The 50/30/ budget method is best suited for those who want a simple and flexible way of maintaining their budget The amounts you spend on items in each category can change from month to month You only need to ensure that you remain within the 50%, 30%, and % spending limits of each category.

How the 50/30/ Budget Works The lean and easytounderstand 5030 budget calculator has been around since at least the early 00s Popularized by Elizabeth Warren in her book, “All Your Worth,” this budget divides 100% of your paycheck (aftertax income) into the three categories Things You Need 50% Things You Want 30% Savings %. Oct 08, 18 · The 50/30/ rule is a simple method to creating a budget All of your money you bring in each month gets divided into only 3 buckets needs, wants, and savings The beauty of this budget is in its simplicity So how does the 50//30 budget work?. Aug 07, 17 · What is the 5030 budgeting method?.

Jan 28, 19 · Why Is The 50/30/ Budget Method Effective?. Aug 17, · The 50/30/ rule (also referred to as the 50//30 rule) is one method of budgeting that can help you keep your spending in alignment with your savings goals Budgets should be about more than just paying your bills on time—the right budget can help you determine how much you should be spending, and on what. 50/30/ budget A simple way to organize your finances, make progress, and avoid stress Creating a budget helps you stay on top of your finances, learn where your money is going, and save for the future Even so, some people can find the task confusing or daunting A 50/30/ budget is a simple, easy way to.

Jun 19, · How To Customize the 50/30/ Budget You can customize the budget to work for you even if you think the percentage categories — 50%, 30% and % — aren’t quite right for your financial lifestyle For example, supposing you need to allocate more of your budget toward needs, you could try 60%. Senator Elizabeth Warren of Massachusetts, a bankruptcy expert who taught. Aug 17, · Let’s take a practical approach on how the 5030 budget rule works Laura is a 24yrs old bank manager who is given a monthly salary of $7,000 But after a tax deduction for things like;.

May 13, · The most significant part of the 50/30/ budget rule is the per cent you put toward your financial goals This part of your budget plan includes saving for retirement and making sure your emergency fund has enough money in it to cover unplanned life events. Health insurance, local tax, income tax, state tax and social security, she is left with a net income of $6,500. Jan 03, · The tactic, referred to as the 50/30/ rule, teaches people how to allocate their money towards paying their various expenses in an efficient way.

Jul 16, 19 · Even though the budget is written as 50/30/, the purpose of this system is to prioritize the saving (the %) (It may be more appropriately named the /50/30 budget, but alas) The ultimate goal of the 50/30/ budget is to make space for the. The 5030 budget (or rule as it’s sometimes referred) is a percentagebased budget concept that emerged in the late 90s This is a popular budgeting style due to its simplicity, flexibility and how it can apply to different stages of life It’s based on percentages and not how much you earn, so you can adapt it to your own circumstances. Feb , 17 · What is the 50//30 Budget?.

Jun 12, 18 · How to budget with the 50//30 rule The simple spending formula that makes it easy to save money without sacrificing your lifestyle The budgeting rule is a simple way to keep spending in check. It compares to an ideal budget If you don’t normally keep track of your spending, using a budgeting tool like Mintcom for a month might be helpful What you should be spending on your needs 50% of your monthly income What you should be spending on wants 30% of your monthly income Savings and. Oct 04, 18 · A 50//30 budget can help you with your budgeting because it will tell you exactly what category your income should go into and exactly how much money should go into each category When you use this method of budgeting it helps you prioritize your money, figure out your wants and your needs, pay off more debt and maximize your savings and.

The 5030 budget (sometimes called the 5030 budget) is an easy and effective way to manage your finances You divide your spending into three different categories needs, wants, and savings To clarify, needs are things like housing, groceries, and car payments. Jun 23, · The 5030 Budget Rule is applicable to any amount of income since this is a percentagebased system Whether you have an entrylevel salary or already on your senior level, you can easily follow this budget rule To get started you need to determine first the income you will be working with For this we will be focusing on the net income. Aug 21, · What is the 5030 budget rule?.

2Person Budget 1Person Budget >. Jun 04, · YNAB is currently my FAVORITE budgeting app, and is a great way to organize your 50 / 30 / budget You can create 3 Sections for this budget (NEEDS, WANTS, SAVINGS/DEBT) and organize your budget categories into those 3 buckets The place to see your 5030 percentages is under the “Reports” tab. The 50/30/ budget can be great for those who don’t like the idea of budgeting, because you only have to break down your spending into three categories Needs, Wants, and Savings Pros of the 50/30/ budget.

Your 50/30/ Monthly Budget Guide Create your 50/30/ budget in four easy steps 1 Calculate Your Total Monthly Income Your aftertax income is the amount you have after all taxes—local, state, federal, Medicare and Social Security—are taken out of your paycheck.

Do You Know About The 50 30 Rule

Why I Hate The 50 30 Budget Club Thrifty

50 30 Budgeting Rule What It Is How It Works

50 20 30 Budget のギャラリー

The 50 30 Rule Of Budgeting Explained Dollarsprout

Budget Percentage Dave Ramsey Vs 50 30 Budget Rule

50 30 Budget Rule Free Budget Spreadsheet Healthy Wealthy Skinny

How To Budget With The 50 30 Rule Swift Salary

Using The 50 30 Rule To Create A Budget

The 50 30 Budget Rule Do You Need It Kinetix Financial Planning

/RulesofThumb-Recirc-40d55d54db404b8f9fb8a223227052a2.jpg)

The 50 30 Rule Of Thumb For Budgeting

Is The 50 30 Rule The Best Way To Budget Your Money

How To Follow The 50 30 Rule Wealthsimple

The 50 Needs 30 Wants Savings Method Of Budgeting Words Of Williams

The 50 30 Budget Rule Made Simple Cents Accountability

50 30 Budget Rule Here S Everything You Need To Know

How To Budget Your Money With The 50 30 Rule

Learn How To Budget For Your Business Using The 50 30 Rule Headoffice Jamaica

Budgeting Tips For Canadians The 50 30 Rule Fresh Start Finance

How The 50 30 Rule Can Help You Budget

The 50 30 Budget Method Defined Financial Best Life

The 50 30 Budget Explained An Easy Budgeting Method To Follow

5030rule

Budgeting What S The 50 30 Rule Leap

New Year Resolution The 50 30 Budget Asset Planning Corporation Knoxville Tn

Money Lover Blog Understand 50 30 A Simple Budgeting Rule

The 50 30 Rule Ramseysolutions Com

Minimalist Budgeting To Get You Back On Track For 19 Cccu

How Does The 50 30 Rule Work W Example Personal Fi Guy

Breaking Down The 50 30 Rule How Do You C U

The 50 30 Budget Rule A Simple Step By Step Guide Money In Your Tea

Everything You Need To Know About The 50 30 Budget Rule Money After Graduation

The 50 30 Budget Anz

The 50 30 Budgeting Rule Infographic

Livewell The 50 30 Rule How To Make Budgeting Easy As Pie

How To Make A Budget Goodbudget

The Ol 50 30 Budget Rule Really Works Budgetry

Revisiting The 50 30 Budgeting Rule

How To Make A 50 30 Budget Goodbudget

50 30 Budget Rule Free Budget Spreadsheet Healthy Wealthy Skinny

How To Budget Like A Pro With The 50 30 Rule Compounding Joy

Ucpb Com The 50 30 Budgeting Rule

Free 50 30 Budget Calculator For Your Foundation Template Tiller Money

Is 50 30 Budget Rule The Best Way To Budget Tsm

How To Budget With The 50 30 Rule I Want A Bit More

What Is The 50 30 Budget Rule And How It Works Mint Notion

Budgeting For Those Who Don T Like To Mogo

What Is The 50 30 Budget Rule And How It Works Mint Notion

How To Set Up Your Budget Categories With The 50 30 Rule

Your Ultimate Guide To The 50 30 Budget Compounding Pennies

50 30 Budget Rule And Spreadsheet With Examples She Saves She Travels

How To Use The 50 30 Rule To Manage Your Finances Wealthface

Monthly Budget Planner What Is 50 30 Budget Rule Foxstylo

Budgeting Using The 50 30 Rule Tfe Times

Beginner Guide To The 50 30 Budget Rule Fluffymind Youtube

50 30 Budgeting Rule From Citizens State Bank

Budgeting By The Numbers The 50 30 Budget Debtguru Credit Counseling And Debt Management Services

10 Steps To Create Your Ultimate Budget Guideline The 50 30 Rule

Learn How To Make A 50 30 Budget Includes Template Financial Stress

How To Budget Using The 50 30 Rule Free Template Finugget

Budgeting By Number The 50 30 Rule Forbes Advisor

The Problem With The 50 30 Budget Rule Eatcheapeatwell

How To Budget With The 50 30 Rule Swift Salary

Budgeting By Number The 50 30 Rule Forbes Advisor

50 30 Rule Of Tracking Budget Yadnya Investment Academy

The Practical Guide To The 50 30 Budgeting Method That Takes Less Than 10 Minutes Dollarnomics

The 50 30 Budget Rule Explained Ultimate Guide Arrest Your Debt

50 30 Budgeting Rule Millennial Going Down

50 10 Budgeting Rule

50 30 Budgeting Rule Calculator Detailed Explanation Intuit Mint

Is The 50 30 Rule The Best Way To Budget Your Money Earn Money 3 0 6

50 30 Budgeting Rule Didn T Work For Me Do This Instead

What Is The 50 30 Rule Budget Paragon Bank

Want To Earn And Grow Rich Apply The Rule Of 50 30

The 50 30 Rule Of Budgeting Step By Step Beginner S Guide

Budget With The 50 30 Rule Crest Accounting

50 30 Budget Rule And Spreadsheet With Examples She Saves She Travels

Pin On Budgeting Group Board

Understanding The 50 30 Rule To Help You Save More Magnifymoney

The Ultimate Guide To Making A 50 30 Budget Free Template

Amb Credit Consultants A New Way To Budget Budgeting Using The 50 30 Rule Budgeting Budgeting Process Financial Education

50 30 Budget With Examples Free Budget Spreadsheet Printables

Free 50 30 Budget Calculator For Your Foundation Template Tiller Money

How To Create A Family Budget With Children Cashfloat

50 30 Budgeting Rule Follow This Rule To Build An Expense Budget Getmoneyrich

The 50 30 Budget Rule A Simple Step By Step Guide Money In Your Tea

50 30 Budget Rule Free Budget Spreadsheet Healthy Wealthy Skinny Budgeting Finances Finance Saving Budgeting

How To Budget Using The 50 30 Rule Bank Of Ireland Blog

What Is The 30 50 Rule

50 30 Budgeting Rule Of Thumb Pharmacist Money Blog

50 30 Rule Free Excel Budgeting Template Dollarplaybook

How To Manage Your Budget With The 50 30 Rule

What Is The 50 30 Budget Learn Here Frugal Financiers

Do You Have Trouble Budgeting Try The 50 30 Rule

:max_bytes(150000):strip_icc()/the-50-30-20-rule-of-thumb-453922-final-5b61ec23c9e77c007be919e1-5ecfc51b09864e289b0ee3fa0d52422f.png)

The 50 30 Rule Of Thumb For Budgeting

50 30 Budget Calculator Nerdwallet

The Formula 50 30 Rule For Budgeting Success Canadian Budget Binder

The 50 30 Budget Rule A Simple Step By Step Guide Money In Your Tea

Infographic Real Life Stats That Bring The 50 30 Budget Rule Into Perspective Rising Tides Financial

6 Budget Myths To Stop Falling For Mint App Budgeting Out To Lunch

50 30 Budgeting Rule Calculator Detailed Explanation Intuit Mint